Table of Content

Lastly, Bay Equity Home Loans is an accredited company with the Better Business Bureau and currently has an ‘A+’ rating. On LendingTree, they have an equally astounding 4.9-star rating out of 5 from more than 18,000 reviews. They also boast a 99% recommend rating and rank in the top five based on customer ratings.

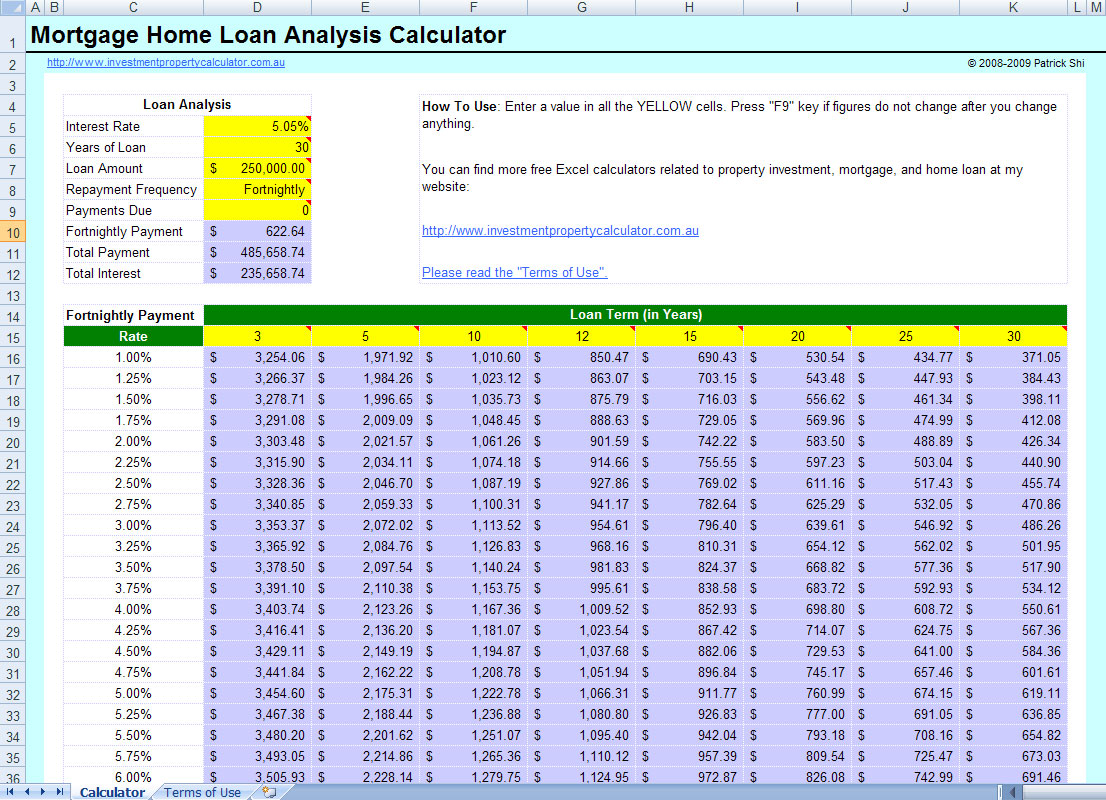

Use the calculator to understand your mortgage repayment options. That might be the highest score I’ve seen for any mortgage lender. And the fact that it’s from that many reviews is super impressive. If you do want a mortgage quote, you’ll need to find one of their loan officers via their website directory, then reach out via phone or email. Bay Equity was founded in San Francisco’s financial district in 2007 and is family-owned and operated. It’s located in Corte Madera, California and is licensed in 42 states, with retail branches in 27 states.

Investment Analyst - Private Equity (m/w/d)

Recommendation score measures the loyalty between a provider and a consumer. It's at +100 if everybody recommends the provider, and at -100 when no one recommends. By SuperMoney users with a score of -100, equating to 1 on a 5 point rating scale.

Finder monitors and updates our site to ensure that what we’re sharing is clear, honest and current. Our information is based on independent research and may differ from what you see from a financial institution or service provider. When comparing offers or services, verify relevant information with the institution or provider's site. Talk with a financial professional if you're not sure.

Investment Analyst

The monthly repayment rate comes from the loan amount, the annual interest rate, and the annual repayment rate. Particularly long fixed interest rates are usually higher. The gal I worked with Patti, had me running here and there over and over again to get documents from the same place. Not a big deal, just had to re submit employment paystubs.

However, the homepage doesn’t mention this feature. Fill out the form and click on “Calculate” to see yourestimated monthly payment. To search for loan officers in your state, go to the Bay Equity homepage and type your state name or abbreviation in the search box. This will pull up a list of the branches and loan officers available in your state. Lenders are available in most states across the US.

Equity Research Analyst

But we’d like to see Bay Equity be a little more transparent about its rates and fees to make the process easier for homebuyers. Mortgage rates change daily based on market conditions and vary significantly depending on the loan type and the length of the term. Find the best interest rate available to you by getting quotes from three or more mortgage lenders before choosing a home loan. If you’re looking for a similar suite of home loan options and haven’t decided in which state you’ll be purchasing a home, consider Axos Bank. It offers a range of mortgage products and is available nationwide.

While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. As of July 2022, Bay Equity Home Loans has a 4.98 out of 5 rating on Zillow from over 8,200 customer reviews. This is both a lot of reviews and a lot of positive reviews for a mortgage lender.

Sign in for the full experience.

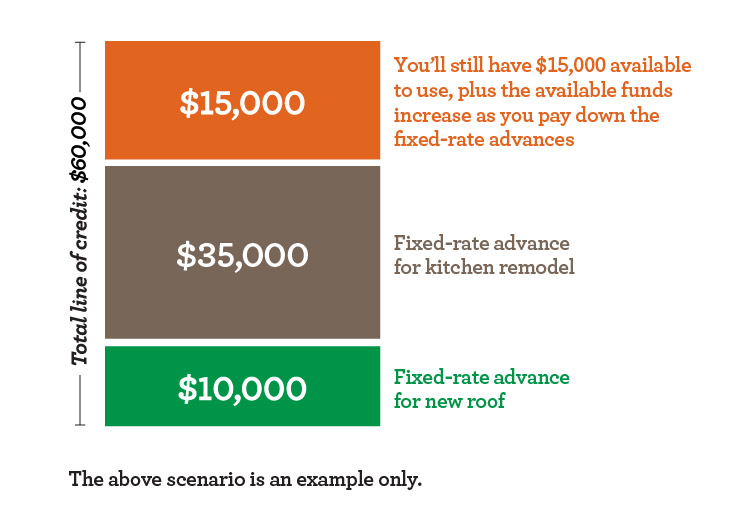

Note that the maximum loan amount you can borrow will also vary depending on the type of mortgage you choose, regardless of the lender you choose. You can refinance mortgages with balances of up to $5,000,000 with Bay Equity Home Loans. Only offers mortgages for multi-family properties, but not for single-family homes or manufactured homes. Another option to narrow down lenders is to use a lending marketplace like Credible or LendingTree.

You don’t need perfect credit to be approved, but the website is lacking in clarity and it’s not available in all states. Discover how one of the most forward-thinking banks in the world can help you take the next step in your career. CEO Robin Vince advocates for a smart regulatory framework to unite the traditional and digital asset systems.

Customers report being happy with the service, the loan officers’ communication skills and expertise, as well as the speed of closing times. Since Bay Equity doesn’t post its rates and fees online, we reached out to a loan officer. You’re required to pay a $450 processing fee and a $995 underwriting fee. These are both lender fees, and the amounts are standard for lenders that charge flat fees instead of a percentage of the total loan amount. Fixed interest rateThe longer you fix the interest rate, the more security you have in planning your mortgage loan.

SuperMoney strives to provide a wide array of offers for our users, but our offers do not represent all financial services companies or products. See if you qualify for student loan refinancing and compare real time offers. This annuity payment consists of both interest and principal repayment. The composition of interest and repayment changes slightly with each month. This is because each repayment reduces the remaining loan balance. Aside from the real estate agent fees, additional purchase costs are usually paid only by the buyer.

Together with our team of experienced brokers, you will understand the nuances of your situation and fine-tune your mortgage decision. To find you the optimal mortgage, we will use our unique Hypofriend Recommendation Engine. We will begin by asking you several key questions, which will help us determine which mortgage products could work best for you. Refinance your existing home in Germany to lower interest rates or cash out on your home equity. Today, our Digital Asset Custody platform bridges digital and traditional assets. Tomorrow, as we continue our innovation journey, we aim to develop an entire suite of digital asset services.